Investment Analysis of the Direct Air Capture and Carbon Utilization Industry

Let’s be honest. The idea of pulling carbon dioxide straight out of thin air sounds like science fiction. But it’s not. Direct Air Capture (DAC) is a very real, rapidly maturing set of technologies, and it’s starting to draw serious capital. For investors, this isn’t just about saving the planet—though that’s a massive driver—it’s about identifying the next frontier in climate tech. A frontier with a potentially trillion-dollar addressable market.

So, what’s the investment case? It’s complex, nuanced, and frankly, a bit of a rollercoaster. High costs, massive energy needs, but also… incredible tailwinds. Government policies like the US Inflation Reduction Act are pouring fuel on the fire, offering tax credits up to $180 per ton of CO2 captured and stored. Corporate net-zero pledges are creating a voracious demand for high-quality carbon removal credits. The momentum is palpable.

The Core Investment Thesis: Why DAC & CCU?

At its heart, the thesis rests on a simple, uncomfortable truth: reducing emissions alone won’t be enough. We’ve already put too much CO2 up there. The Intergovernmental Panel on Climate Change (IPCC) is clear—we need carbon removal, at gigaton scale, to hit our climate goals. That’s the “why.” DAC, combined with Carbon Capture and Utilization (CCU), which turns captured CO2 into products, offers a path.

The Two-Pronged Value Proposition

Investors are really looking at two distinct, but linked, revenue streams:

- Carbon Removal as a Service: Selling verified, durable carbon removal credits to corporations (tech giants, finance, aviation) desperate to offset their hardest-to-abate emissions. This is the premium, subscription-like model.

- Carbon Utilization & Products: Transforming CO2 into something valuable. Think low-carbon fuels, concrete, chemicals, even materials for sneakers. This is the circular economy play—creating a market where CO2 is a feedstock, not a waste product.

The sweet spot? Companies that can do both. That’s where scalability and unit economics start to look really attractive.

Breaking Down the Risks (And They Are Substantial)

Okay, let’s not sugarcoat it. This is a high-risk, potentially high-reward sector. You have to go in with eyes wide open. Here are the big hurdles.

The Elephant in the Room: Cost and Energy

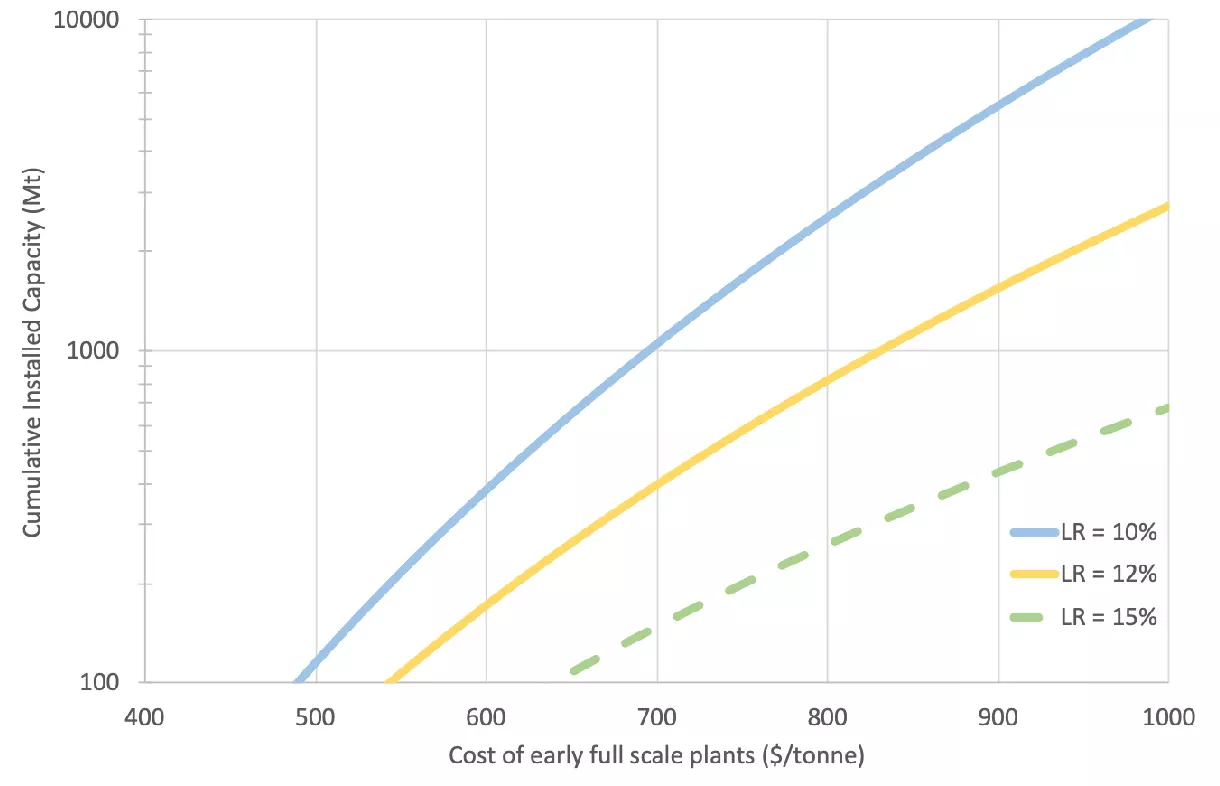

DAC is energy-intensive. Incredibly so. Today’s costs can range from $600 to over $1,000 per ton captured. The industry’s holy grail is getting below $100/ton. The path there? Brutal innovation in sorbent materials (the chemical “sponges” that grab the CO2), process engineering, and, crucially, access to cheap, abundant renewable energy. A DAC plant is basically a giant energy sink. If it’s powered by fossil fuels, you’re undermining the whole point.

Policy Dependency & Market Creation

This market is policy-born. The $180/ton 45Q tax credit in the US? A game-changer. But policy can giveth, and policy can taketh away. Long-term investment requires regulatory certainty across administrations and borders. Similarly, the voluntary carbon market for removals is still young, with evolving standards around permanence and verification. It’s a bit of a wild west.

Technological Scaling & “Winner” Risk

Multiple technological approaches are vying for dominance—solid sorbent vs. liquid solvent systems, high-temperature vs. low-temperature processes. Betting on a single company is a bet on their specific tech stack scaling flawlessly. There’s a real risk of backing the “Betamax” of DAC while the “VHS” wins out.

Mapping the Investment Landscape: Where to Place Your Bets

So, where does the smart money look? The value chain offers several entry points, each with a different risk/reward profile.

| Investment Segment | Key Players/Examples | Risk/Reward Profile |

| Pure-Play DAC Developers | Climeworks, Carbon Engineering | Highest risk, highest potential reward. Pure technology & scaling bet. |

| Integrated Energy Majors | Occidental Petroleum (1PointFive), Chevron | Lower tech risk, massive scaling capital. Tied to fossil legacy. |

| Carbon Utilization Innovators | LanzaTech, CarbonCure, Twelve | Product/market risk. Faster path to revenue via concrete, fuels, etc. |

| Enabling Technology & Services | Sorbent manufacturers, project developers, MRV (Measurement, Reporting, Verification) platforms | “Picks and shovels” play. Often less volatile, B2B model. |

Frankly, the involvement of oil and gas giants is a double-edged sword. They have the project management expertise and capital to build at scale, sure. But for ESG-focused funds, that association is a real tension point.

Key Metrics for Evaluating DAC & CCU Opportunities

You can’t just invest on vibes. When digging into a company, here’s what to scrutinize:

- Cost Per Ton Trajectory: Not just today’s cost, but their credible roadmap to sub-$100. What’s their magic sauce?

- Energy Source & Footprint: Is their pilot/demo plant powered by 100% renewables? This is non-negotiable for long-term viability and credit quality.

- Offtake Agreements: Have they secured pre-purchases for their carbon removal credits or products? Microsoft, Stripe, Airbus—these are anchor customers that de-risk scale-up.

- Partnerships: Are they teamed with engineering firms (like Worley, Fluor) and community stakeholders? This isn’t a garage-scale startup game.

- IP & Sorbent Durability: How many capture/release cycles does their core material last? Replacing it constantly kills economics.

The Future Is… Conditional

Here’s the deal. The direct air capture and carbon utilization industry won’t be the single solution to climate change. It’s a vital piece of a massive, messy puzzle. The investment opportunity is real and potentially enormous, but it’s not for the faint of heart or those seeking quick returns.

It’s a bet on human ingenuity meeting policy support meeting desperate market demand. The companies that survive the next decade will likely be those that master not just the chemistry, but the gritty realities of logistics, community engagement, and building a real business around what was once just air.

In the end, investing here is a statement. It’s a belief that we can not only imagine a tool to clean up our atmospheric mess, but that we can build it, affordably, and even profit from it. That’s a powerful narrative. And it might just be a necessary one.